XRP Price Prediction: Technical Breakout and ETF Optimism Signal Path to $5

#XRP

- Technical indicators show XRP trading above key moving average with bullish momentum building

- ETF expectations and Asian adoption creating positive fundamental backdrop despite whale selling

- Elliott Wave analysis supports $5 target as pattern approaches completion phase

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

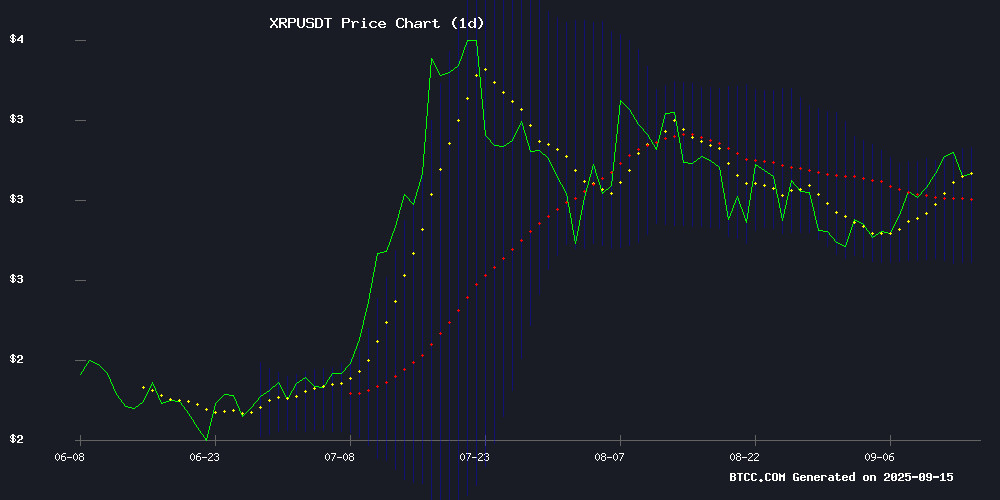

XRP is currently trading at $2.9828, positioned above its 20-day moving average of $2.9143, indicating underlying strength. The MACD reading of -0.0698 | 0.0188 | -0.0886 suggests bearish momentum is weakening, while price action NEAR the upper Bollinger Band at $3.1298 points to potential upward movement. According to BTCC financial analyst Sophia, 'The technical setup favors continued upside, with a break above $3.13 potentially triggering further gains toward resistance levels.'

Market Sentiment: ETF Hopes and Adoption Drive Positive Outlook

Market sentiment for XRP remains bullish amid growing ETF expectations and Asian adoption trends. Despite whale selling of 40 million coins, the overall narrative focuses on institutional developments and staking innovations. BTCC financial analyst Sophia notes, 'The combination of regulatory progress through XLS-86 firewall implementation and new staking platforms like XRP Tundra creates a fundamentally supportive environment for price appreciation.'

Factors Influencing XRP's Price

XRP ETF Expectations Fuel Bullish Market Sentiment Amid SEC Deadline Extension

Market optimism around XRP has surged as the U.S. Securities and Exchange Commission (SEC) delays its decision on multiple spot XRP ETF applications to October. Analysts speculate this could be a pivotal moment for the cryptocurrency, with potential institutional inflows driving price action.

Eight major firms, including Bitwise, Grayscale, and Franklin Templeton, await regulatory approval. Their filings are seen as a gateway for institutional capital, though immediate price rallies remain uncertain. XRP recently breached $3 amid bullish momentum, with traders closely watching October's developments.

XRP Price Prediction: Elliott Wave Analysis Suggests $5 Target Remains Viable

XRP continues to consolidate within a narrow range following its earlier bullish surge. The token's ability to hold critical support levels will determine its next directional move, with technical patterns keeping the long-term $5 target in play.

Weekly charts reveal a persistent bearish divergence, yet the overarching uptrend remains intact. Analysts note this divergence warrants caution but doesn't negate the broader bullish structure. The daily chart shows XRP retesting a pivotal $2.97–$3.10 zone, where a decisive break either way could set the tone for near-term price action.

Key support rests at $2.97, with $2.90 acting as a secondary defense line. A breach below $2.79 would invalidate the current bullish thesis. Conversely, reclaiming $3.10 would confirm strength and potentially fuel upward momentum.

XRP Nears Critical Juncture as Elliott Wave Pattern Nears Completion

XRP has rebounded 12% from its September 1 low of $2.70, now testing resistance at $3.03 amid broader crypto market recovery. The asset faces a decisive moment as it approaches the apex of a four-month contracting triangle pattern identified by analyst Matthew Dixon.

The technical setup shows textbook Elliott Wave progression: July's $3.66 peak (wave A) gave way to August's $2.72 trough (wave B), followed by a $3.38 retracement (wave C) before September's $2.70 test (wave D). Current price action flirts with the pattern's upper boundary at $3.05, presenting traders with two scenarios.

An immediate breakout could propel XRP toward $3.90—a 30% upside potential—while rejection at resistance may trigger one final dip to $2.655 before resolution. Market participants await confirmation of either directional bias as the triangle's energy compresses.

XRP Whales Dump 40M Coins Despite ETF Debut, Signaling Market Caution

XRP markets face a paradox as whale selling intensifies despite the launch of the REX-Osprey ETF. On-chain data reveals holders of 10M-100M XRP liquidated 40M tokens in 24 hours, undermining optimism around institutional adoption.

The ETF's debut failed to stem persistent outflows from major wallets. CryptoQuant metrics show whale transaction flows deeply negative, with the 30-day moving average confirming sustained distribution. This divergence suggests institutional players remain skeptical of near-term price catalysts.

Regulatory uncertainty compounds the bearish sentiment. SEC delays on the Franklin Templeton XRP ETF application have left the market in limbo, with no clear timeline for additional product approvals. The regulatory fog appears to outweigh potential inflows from existing ETF products.

XRP Price Prediction: What Next After Strong Rebound

XRP has demonstrated resilience, trading around $3.04 after defending a critical support level near $2.70 earlier this month. Analysts now eye a potential climb to $3.40 as bullish momentum builds. The token's recovery from its recent pullback marks one of the strongest rebounds in weeks, reigniting trader interest.

Trading activity surged as XRP breached the psychological $3.10 barrier, with market analyst Mirsad amplifying attention through a 10,000 XRP giveaway worth approximately $31,000. While the promotion didn't impact liquidity, it underscored growing community enthusiasm around the breakout.

Technical indicators suggest sustained upward potential. Short-term moving averages have begun trending upward, typically a precursor to continued bullish movement. The decisive rebound from $2.70—where demand consistently materialized—signals renewed confidence among buyers.

XRP Price Prediction: Bullish Momentum Builds on ETF Hopes and Asian Adoption

XRP's price trajectory is drawing aggressive forecasts as market analysts point to two catalytic drivers: potential ETF approval in the U.S. and accelerating adoption across Southeast Asia. Jake Claver of Digital Ascension Group projects a base case of $10–$13, with a bull case reaching $20–$25 if regulators greenlight an XRP-focused exchange-traded fund this year. "ETF approval would open the floodgates for institutional capital," Claver noted, emphasizing the liquidity surge that followed Bitcoin and Ethereum ETF launches.

Parallel momentum stems from Ripple's deepening foothold in Southeast Asian payment corridors. While the article truncates before detailing specific partnerships, the region's progressive stance on crypto utility aligns with XRP's cross-border settlement use cases. Market observers suggest real-world adoption could compound the speculative boost from potential ETF inflows.

XRPL Scam Protection Strengthens with New XLS-86 Firewall

The XRP Ledger community is advancing a unified defense mechanism against scams, dubbed the "XRP firewall." Spearheaded by Vet, a dUNL validator, the proposed XLS-86 amendment aims to consolidate fragmented safeguards into a single framework. The firewall promises to block fraudulent activity targeting XRP, tokens, and NFTs, with Vet asserting it could eliminate asset losses if activated.

Recent vulnerabilities, including a compromised xrpl.js library incident in April 2025, have underscored the need for proactive security measures. While platforms like XRplorer currently flag suspicious addresses, the XLS-86 initiative seeks to institutionalize protection at the protocol level.

Best Crypto Staking Platforms Expand as XRP Tundra Launches Revolutionary XRP Staking Service

XRP Tundra has introduced a native staking protocol on the XRP Ledger, enabling holders to earn rewards through Cryo Vaults without leaving the ecosystem. This marks the first time XRP can generate passive income while maintaining the security of XRPL.

The staking process is designed for simplicity. Users commit XRP for periods ranging from 7 to 90 days, after which their tokens are automatically returned alongside TUNDRA token rewards. The system eliminates complex smart contracts and cross-chain risks, making staking accessible to anyone who can send XRP.

This development transforms XRP from a pure payments asset into a productive one, allowing long-term holders to grow their portfolios while retaining custody. The launch represents a significant milestone for the XRP ecosystem, aligning it with other staking-enabled blockchains.

Ripple Investors Receive Discounted Claim Offers From Cherokee; Deaton Explains IPO Outlook

Cherokee Acquisition, a firm specializing in distressed asset claims, has extended offers to Ripple investors holding shares through Linqto Texas, LLC. The proposal outlines a tiered pricing structure: claims exceeding $100,000 are valued at 70-75% of face value, while smaller claims are priced at 65-70%. Investors face a trade-off—immediate liquidity at a discount or holding for potential future distributions.

Attorney John Deaton contextualized the move, noting secondary market prices for Ripple shares now hover near $100—a stark contrast to the $40 entry point for some early investors. Firms like Cherokee capitalize on this disparity, acquiring claims at depressed rates and profiting from eventual payouts. Market observers speculate whether Ripple’s anticipated IPO could further narrow the gap between distressed sale prices and actual valuations.

Staking XRP Made Simple: XRP Tundra Unveils User-Friendly Platform

XRP Tundra has introduced a native staking solution for XRP holders, addressing a long-standing gap in the ecosystem. The platform enables users to earn yield through Cryo Vaults, offering fixed-term staking options from 7 to 90 days with TUNDRA token rewards.

The system eliminates complexities like cross-chain bridges or third-party custody, leveraging the XRP Ledger's native functionality. A dual-token model and reserved 50 million TUNDRA-X supply aim to sustain attractive, tiered rewards—particularly for longer lock-up periods.

This development aligns XRP with yield-generating networks like Ethereum and Solana, transforming idle assets into productive holdings while maintaining XRP's hallmark transaction simplicity.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP shows strong potential for upward movement. The price currently at $2.9828 is testing key resistance near the upper Bollinger Band at $3.1298. A successful break above this level could target the $3.50-$3.75 range in the near term.

Elliott Wave analysis supports a longer-term target of $5, particularly given the positive ETF sentiment and growing Asian adoption. The recent whale selling appears to be profit-taking rather than fundamental concerns, as institutional interest remains strong through Cherokee claim offers and IPO outlook discussions.

| Target Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $3.50 | High | 2-4 weeks | Bollinger Breakout, MACD improvement |

| $4.00 | Medium | 6-8 weeks | ETF approval progress, staking adoption |

| $5.00 | Medium | 3-6 months | Elliott Wave completion, Asian market expansion |